Financial technology, or fintech, is revolutionizing the banking industry by offering innovative and convenient digital solutions to traditional financial services. Fintech refers to a broad range of technological innovations that aim to improve and automate the delivery and use of financial services. From mobile banking and digital payments to robo-advisors and online lending, fintech is changing the way we access and manage our money.

The origins of fintech can be traced back to the 1950s, with the advent of credit cards and electronic payment processing. However, it wasn’t until the emergence of mobile technology and the Internet in the 21st century that fintech began to disrupt the traditional banking industry. Today, fintech is a multi-billion dollar industry that has transformed the way we interact with money and financial services.

Fintech companies offer a variety of benefits over traditional banking institutions. For example, fintech apps and services are often more convenient and accessible, as they can be accessed from anywhere with an Internet connection or smartphone. Fintech companies also tend to have lower fees and more competitive rates than traditional banks, and they are often able to offer faster and more efficient services. In addition, fintech companies are increasingly focused on serving underserved populations, such as the unbanked and underbanked, by offering alternative financial services and products.

The rise of fintech is having a significant impact on traditional banking institutions. As more consumers turn to fintech solutions for their financial needs, traditional banks are being forced to adapt and evolve in order to remain relevant. This has led to a shift towards digital banking and the closure of brick-and-mortar branches, as well as increased investment in technology and innovation.

Overall, fintech is changing the face of the banking industry and offering consumers more options and better services than ever before. In the rest of this article, we will explore the rise of fintech in more detail, including its various types, advantages and challenges, examples of successful companies, and predictions for the future.

The Rise of Fintech

The rise of fintech is a result of several factors, including changing consumer preferences, advances in technology, and regulatory reforms. Fintech companies are gaining popularity because they offer a more convenient, accessible, and affordable alternative to traditional banking institutions. In contrast to traditional banks, fintech companies are often more nimble and agile, allowing them to quickly adapt to changing market conditions and consumer needs.

Fintech is different from traditional banking in several ways. For example, fintech companies often offer more personalized and tailored services than traditional banks. They also tend to be more transparent and upfront about fees and charges, making it easier for consumers to understand and compare financial products and services. Fintech companies also leverage data and technology to provide more efficient and faster services, such as instant payments and real-time investment advice.

The impact of fintech on traditional banking is significant. Traditional banks are increasingly facing competition from fintech companies, which are able to offer more innovative and advanced services. This is leading to a shift towards digital banking, as traditional banks invest in technology and online platforms to remain competitive. Traditional banks are also facing pressure to lower fees and improve customer service, in order to keep up with the high standards set by fintech companies.

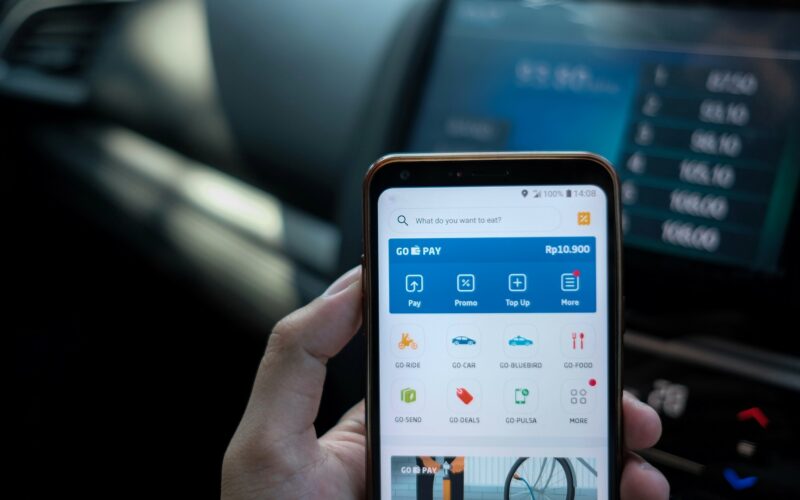

Fintech is disrupting the traditional banking industry in many ways. One of the most significant ways is through the use of mobile banking apps. Mobile banking apps allow customers to check their balances, transfer funds, and pay bills from their smartphones, without having to visit a physical bank branch. This is a convenient and time-saving feature that has become increasingly popular in recent years.

Another way that fintech is disrupting the traditional banking industry is through the use of digital payments. Digital payments allow consumers to make payments electronically, without the need for cash or checks. This is a fast and secure way to make payments, and it is becoming increasingly popular as more consumers embrace mobile technology and online shopping.

Overall, the rise of fintech is changing the banking industry in fundamental ways. Fintech companies are offering more innovative, convenient, and affordable services than ever before, and traditional banks are feeling the pressure to keep up. As technology continues to evolve, it is likely that fintech will continue to disrupt and transform the banking industry in the years to come.

Types of Fintech

Fintech encompasses a wide range of digital technologies and innovations that aim to improve and streamline financial services. Here are some of the most common types of fintech and how they are changing the financial industry:

- Mobile Banking: Mobile banking allows customers to access their bank accounts, check their balances, transfer money, and pay bills using their smartphones or other mobile devices. Mobile banking apps have become increasingly popular in recent years, as they offer a convenient and secure way to manage finances on-the-go.

- Online Lending: Online lending is a type of fintech that allows borrowers to access loans online, without having to visit a physical bank branch. Online lenders use advanced algorithms and data analytics to assess creditworthiness and determine loan terms, which can result in faster loan approvals and more competitive rates.

- Digital Payments: Digital payments allow consumers to make payments electronically, without the need for cash or checks. Digital payment platforms, such as PayPal, Venmo, and Square Cash, have become increasingly popular in recent years, as they offer a fast, convenient, and secure way to make payments online or in-person.

- Robo-Advisors: Robo-advisors are digital platforms that use algorithms and data analytics to provide automated investment advice and portfolio management. Robo-advisors typically charge lower fees than traditional financial advisors, making them a more affordable option for investors.

- Cryptocurrency: Cryptocurrency is a digital or virtual currency that uses cryptography to secure and verify transactions and control the creation of new units. Cryptocurrency, such as Bitcoin and Ethereum, has gained popularity in recent years as an alternative to traditional currencies and a potential investment opportunity.

- Crowdfunding: Crowdfunding is a type of fintech that allows individuals and businesses to raise funds online from a large number of investors. Crowdfunding platforms, such as Kickstarter and Indiegogo, have become increasingly popular in recent years, as they offer a way for entrepreneurs and startups to access capital without relying on traditional funding sources.

Each type of fintech offers unique benefits and challenges, and consumers and businesses should carefully evaluate their options before choosing a fintech provider. However, as technology continues to evolve, fintech is likely to continue disrupting and transforming the financial industry in the years to come.

Advantages and Challenges of Fintech

Fintech has transformed the financial industry in many ways, offering a range of benefits for consumers and businesses. However, fintech also faces a number of challenges and risks that must be addressed in order to ensure the continued growth and success of the industry.

Advantages of Fintech:

- Convenience: Fintech offers a more convenient and accessible way to manage finances. Consumers can access their accounts and financial services from anywhere, at any time, using their smartphones or other mobile devices. This has made it easier for people to stay on top of their finances and make payments, investments, and other financial decisions on-the-go.

- Lower costs: Fintech companies often have lower overhead costs than traditional banks, which allows them to offer more affordable services to customers. This is especially true for online lenders and robo-advisors, which can offer lower fees and interest rates than traditional banks and financial advisors.

- Increased access to financial services: Fintech has made it easier for underserved populations, such as the unbanked and underbanked, to access financial services. Fintech companies are increasingly offering alternative financial services and products, such as mobile banking, digital payments, and microloans, to people who might not have access to traditional banking services.

- Personalized services: Fintech companies use data and algorithms to provide personalized financial advice and services to customers. This can help consumers make more informed financial decisions and achieve their financial goals more efficiently.

Challenges of Fintech:

- Regulatory challenges: Fintech companies face a complex regulatory environment that varies by country and region. Compliance with regulations, such as anti-money laundering and data privacy laws, can be costly and time-consuming for fintech companies.

- Cybersecurity risks: Fintech companies are vulnerable to cybersecurity threats, such as hacking, data breaches, and identity theft. These risks can compromise customer data and damage the reputation of fintech companies, which rely on trust and security to attract and retain customers.

- Lack of trust: Fintech is a relatively new industry, and some consumers may be hesitant to trust fintech companies with their financial information and transactions. Building trust with customers is critical for fintech companies, and they must be transparent and upfront about their fees, security measures, and data privacy policies.

- Integration with traditional banking: Fintech companies must be able to integrate with traditional banking systems and infrastructure in order to offer their services to customers. This can be challenging, as traditional banks are often slow to adopt new technology and may be resistant to working with fintech companies.

Overall, the advantages of fintech outweigh the challenges, and fintech is poised to continue transforming the financial industry in the years to come. However, fintech companies must be proactive in addressing regulatory, cybersecurity, and trust issues in order to build a strong and sustainable industry that benefits consumers and businesses alike.

Examples of Fintech Companies

Fintech companies have disrupted the traditional banking industry by offering innovative and convenient digital solutions to financial services. Here are some examples of successful fintech companies and how they have transformed the financial industry:

- PayPal: PayPal is one of the most well-known fintech companies, offering a platform for digital payments and money transfers. PayPal has over 377 million active accounts worldwide and is widely used for online shopping and e-commerce transactions. PayPal’s success has helped to make digital payments a mainstream option for consumers and businesses alike.

- Square: Square is a fintech company that offers a range of services, including mobile payments, online payments, and point-of-sale systems. Square has disrupted the traditional payments industry by offering affordable and easy-to-use payment solutions for small businesses and entrepreneurs. Square has also expanded into the lending space, offering small business loans through its Square Capital platform.

- Stripe: Stripe is a fintech company that offers a platform for online payments and subscription services. Stripe has become a popular choice for businesses that operate online, such as e-commerce stores and software-as-a-service (SaaS) providers. Stripe’s success is due in part to its focus on providing an easy and seamless payment experience for both businesses and consumers.

- Robinhood: Robinhood is a fintech company that offers a commission-free platform for stock trading and investment. Robinhood has disrupted the traditional brokerage industry by offering a more affordable and accessible way to invest in stocks and other securities. Robinhood’s success has helped to make investing more accessible to younger and less experienced investors.

- Chime: Chime is a fintech company that offers a mobile banking platform and debit card. Chime has disrupted the traditional banking industry by offering a more convenient and affordable way to manage finances. Chime has no monthly fees or minimum balance requirements and offers a range of features, such as early direct deposit, automatic savings, and fee-free overdraft protection.

These are just a few examples of the many successful fintech companies that are transforming the financial industry. Each of these companies has disrupted traditional financial services in its own unique way, offering more convenience, accessibility, and affordability for consumers and businesses alike. As fintech continues to evolve, it is likely that we will see more innovative and disruptive companies emerge in the years to come.

The Future of Fintech

The future of fintech is both exciting and uncertain, as technological advancements and changing consumer preferences continue to reshape the financial industry. Here are some of the trends and predictions for the future of fintech:

- Blockchain technology: Blockchain technology has the potential to transform the financial industry by offering a secure and decentralized way to store and transfer financial assets. Blockchain technology can be used for a variety of financial applications, such as payments, settlements, and identity verification. Fintech companies are increasingly exploring the use of blockchain technology to improve security and efficiency in financial transactions.

- Artificial intelligence (AI) and machine learning: AI and machine learning are being used by fintech companies to provide personalized financial advice and tailored products and services. AI and machine learning can help fintech companies analyze vast amounts of data and make more informed financial decisions for customers. Fintech companies are also using AI and machine learning to detect fraud and prevent cybersecurity threats.

- Open banking: Open banking is a concept that allows customers to share their financial data with third-party providers, such as fintech companies, in order to access new and innovative financial services. Open banking has the potential to increase competition and innovation in the financial industry, as it allows fintech companies to access valuable financial data and develop new products and services that meet customer needs.

- Greater focus on financial inclusion: Fintech companies are increasingly focused on serving underserved populations, such as the unbanked and underbanked, by offering alternative financial services and products. Fintech companies are using technology to provide more affordable and accessible financial services to people who might not have access to traditional banking services.

- Integration with traditional banking: Fintech companies are likely to continue to integrate with traditional banking systems and infrastructure in order to offer their services to customers. This integration can be challenging, as traditional banks are often slow to adopt new technology and may be resistant to working with fintech companies. However, as fintech continues to disrupt and transform the financial industry, traditional banks are likely to become more open to working with fintech companies in order to remain competitive.

The future of fintech is uncertain, but it is clear that fintech will continue to disrupt and transform the financial industry in the years to come. Fintech companies are well-positioned to offer innovative and convenient solutions to financial services, and traditional banks will need to adapt and evolve in order to keep up with the fast-changing industry. The future of fintech is exciting, and consumers and businesses alike can expect to see new and innovative products and services in the years to come.

Conclusion

Fintech has revolutionized the financial industry, offering innovative and convenient digital solutions to traditional financial services. Fintech companies have disrupted traditional banks by offering more affordable, accessible, and personalized financial services to consumers and businesses. Fintech has also increased competition and innovation in the financial industry, forcing traditional banks to adapt and evolve in order to remain relevant.

While fintech offers many advantages, such as convenience, affordability, and greater access to financial services, it also faces challenges and risks, such as cybersecurity threats and regulatory compliance. Fintech companies must continue to address these challenges and risks in order to build a strong and sustainable industry that benefits consumers and businesses alike.

Looking to the future, fintech is likely to continue to disrupt and transform the financial industry, with trends such as blockchain technology, artificial intelligence, and open banking paving the way for more innovation and competition. As fintech companies and traditional banks continue to adapt and evolve, consumers and businesses can expect to see more convenient, personalized, and affordable financial services in the years to come.

In conclusion, fintech has changed the face of the financial industry, offering more convenient, affordable, and accessible solutions to traditional financial services. While challenges and risks exist, fintech is well-positioned to continue disrupting and transforming the industry in exciting ways, and consumers and businesses can expect to benefit from the many advantages that fintech has to offer.